Find present value of annuity

Present Value of Annuity Continuous Compounding PVACC Calculator. Once the value per dollar of cash flows is found the actual periodic cash flows can be multiplied by the per.

Present Value Of An Annuity Formula Wall Street Mojo 2020 Download Scientific Diagram

The Net Present Value is difficult to calculate by hand since the formula is very complex.

. Present Value Growing Annuity PVGA Payment Calculator. Present value of an annuity is finance jargon meaning present value with a cash flow. Use the PV of 1 Table to find the rounded present value figure at the intersection of n 12 3 years x 4 quarters and i 2 8 per year 4 quarters.

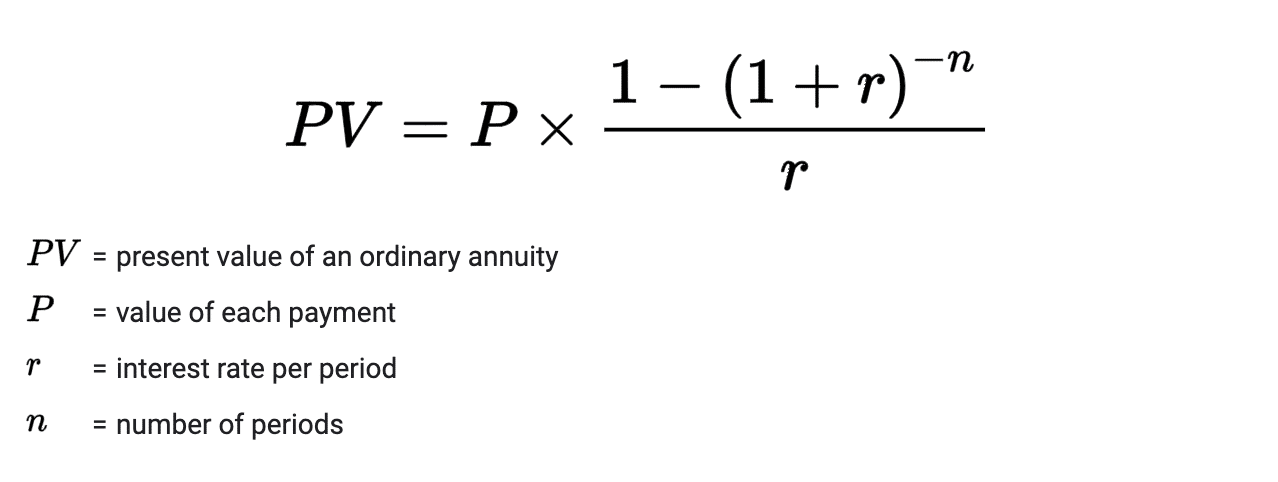

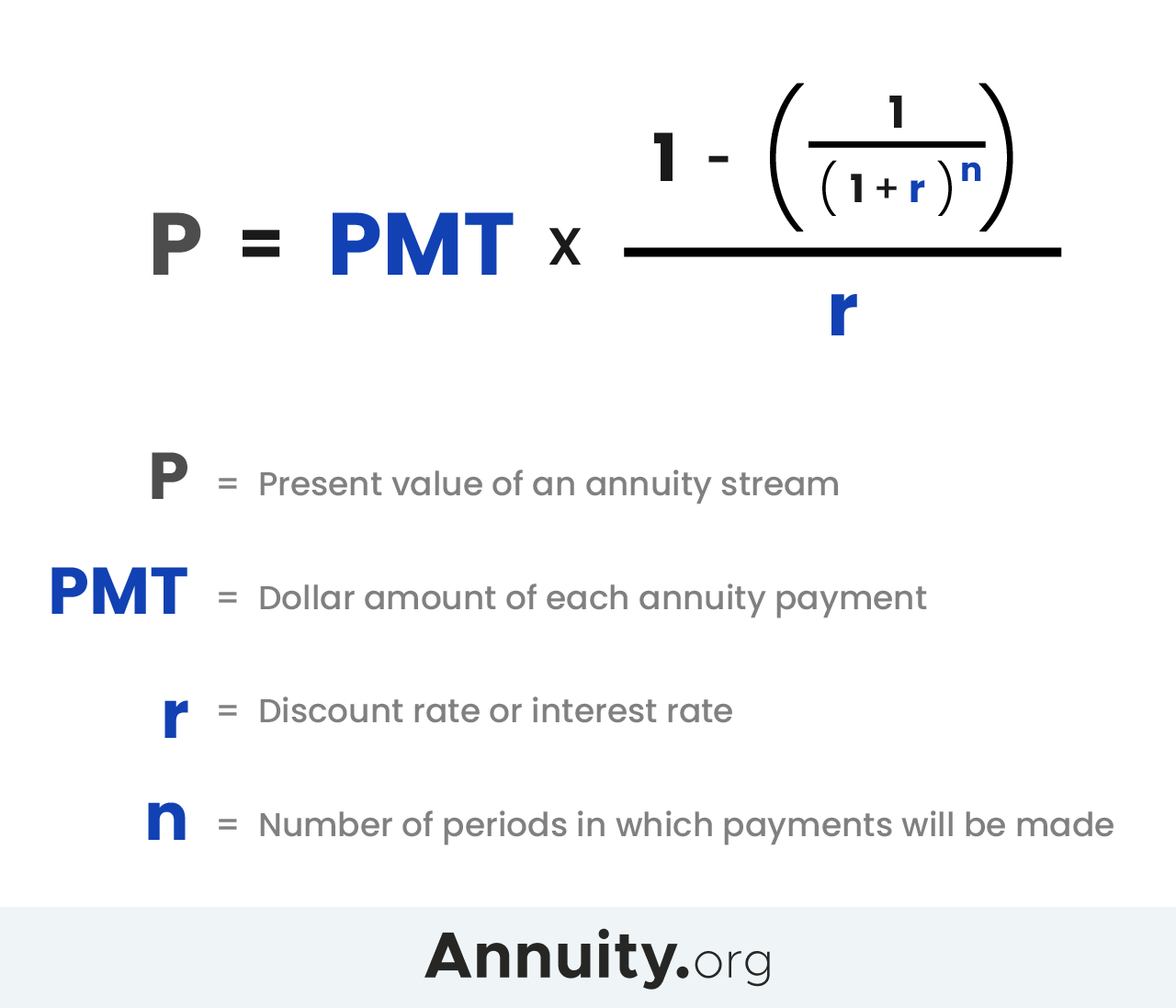

A present value calculation is also an effective way to compare different pension choices. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Present value is linear in the amount of payments therefore the.

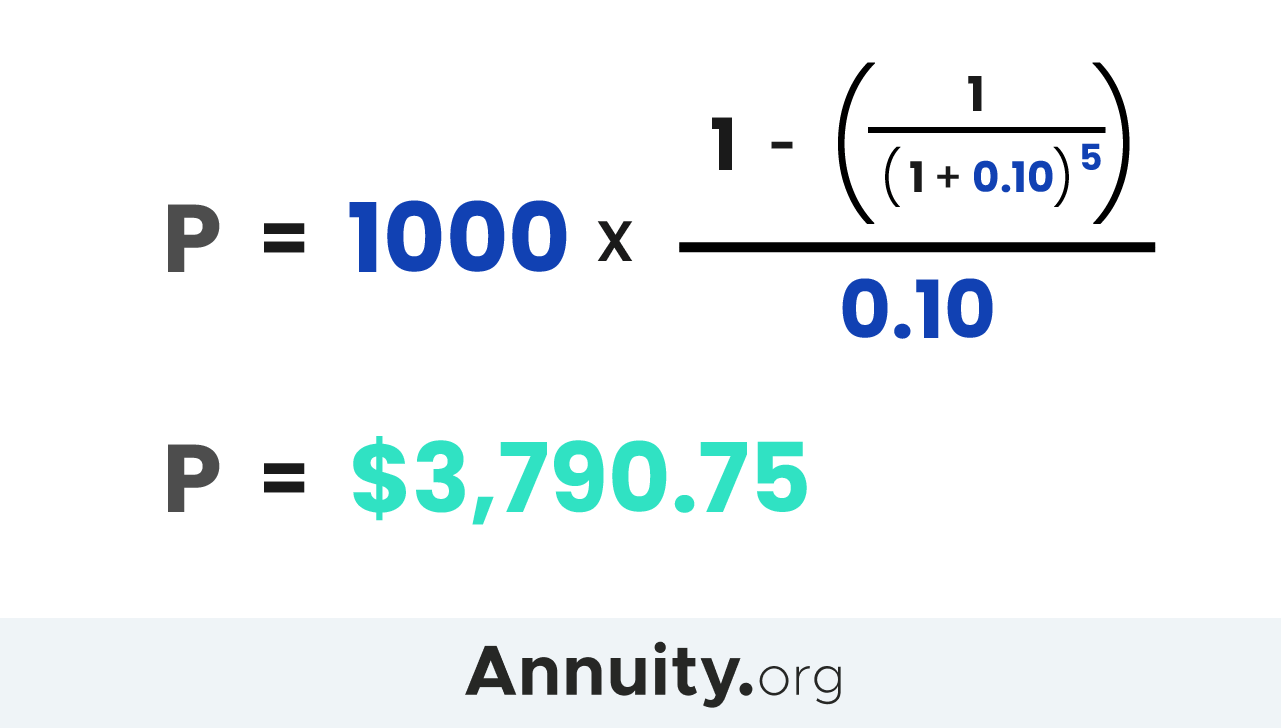

For example to find the present value of a series of three 100 payments made at equal intervals and discounted at 10 you can perform these calculations. Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest. The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money.

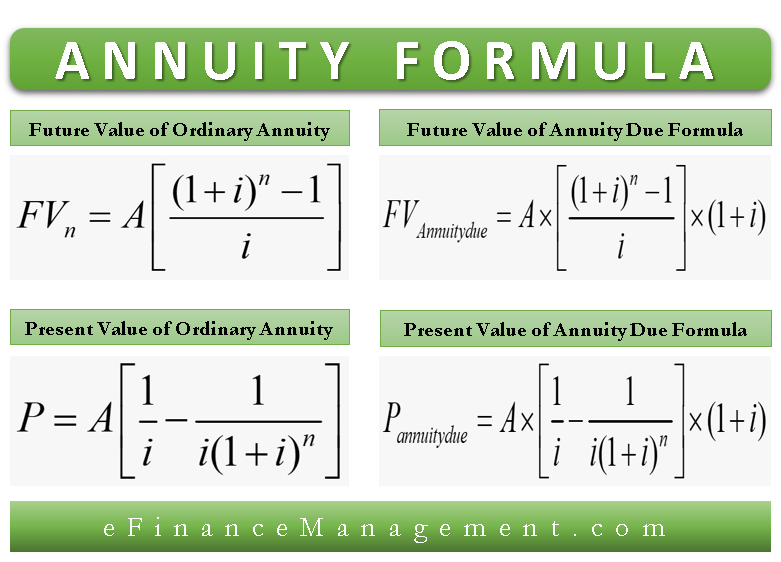

Calculating the Future Value of an Ordinary Annuity. This future value of annuity calculator estimates the value FV of a series of fixed future annuity payments at a specific interest rate and for a no. The annuity table provides a quick way to find out the present and final values of annuities.

However in the real world interest rates and time periods are not always discrete. The cash flow may be an investment payment or savings cash flow or it may be an income cash flow. Present Value of Annuity PVA Calculator.

By default this value is the same as the Pre-discounted Fair Market Value. Where is the number of terms and is the per period interest rate. Present Value Annuity Factor PVAF Calculator.

The present value of receiving 5000 at the end of three years when the interest rate is compounded quarterly requires that n and i be stated in quarters. An annuity table or present value table is simply a tool to help you calculate the present value of your annuity. Present Value Of An Annuity.

Based on the time value of money the present value of your annuity is not equal to the accumulated value of the contract. You can find derivations of present value formulas with our present value calculator. Net Present Value formula is often used as a mechanism in estimating the enterprise value of a company.

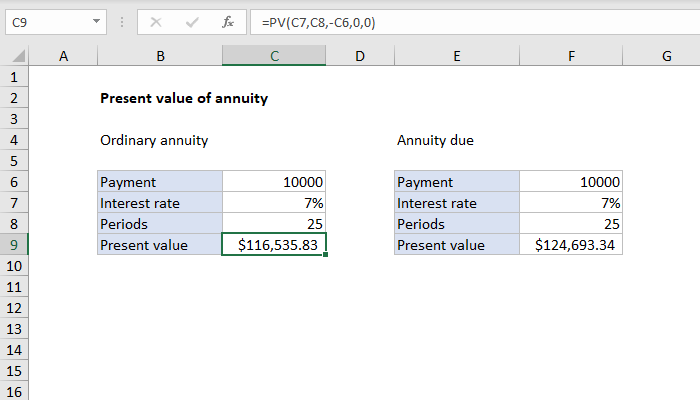

The value of bonds. The present value is given in actuarial notation by. Excel can be an extremely useful tool for these calculations.

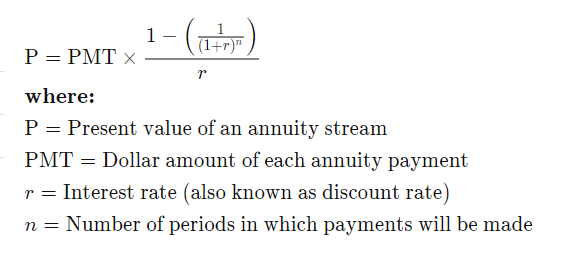

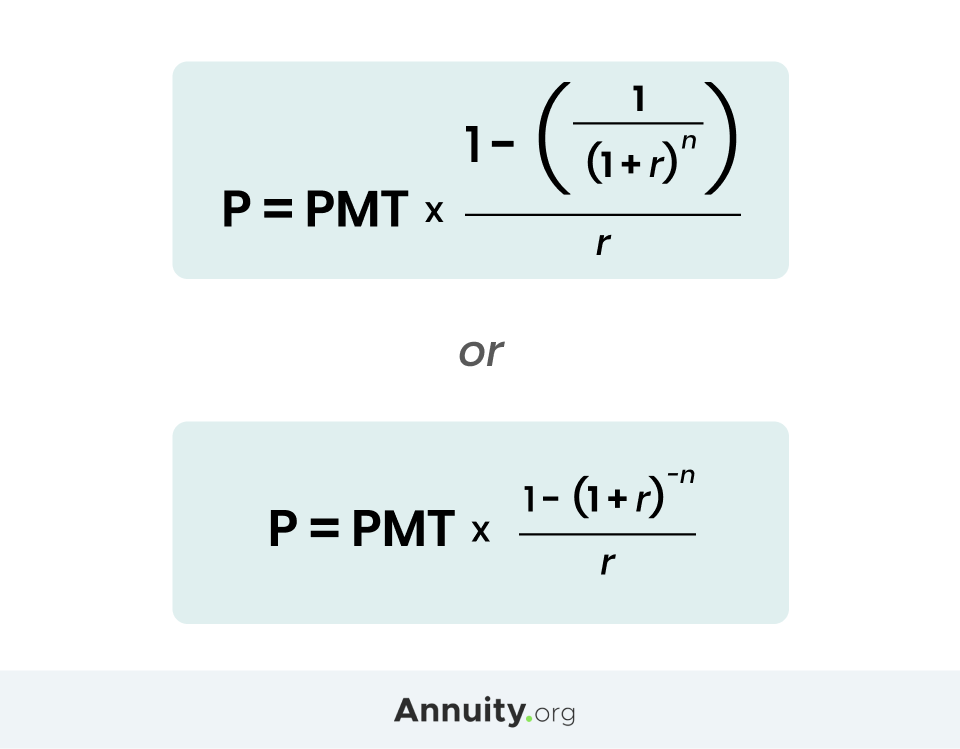

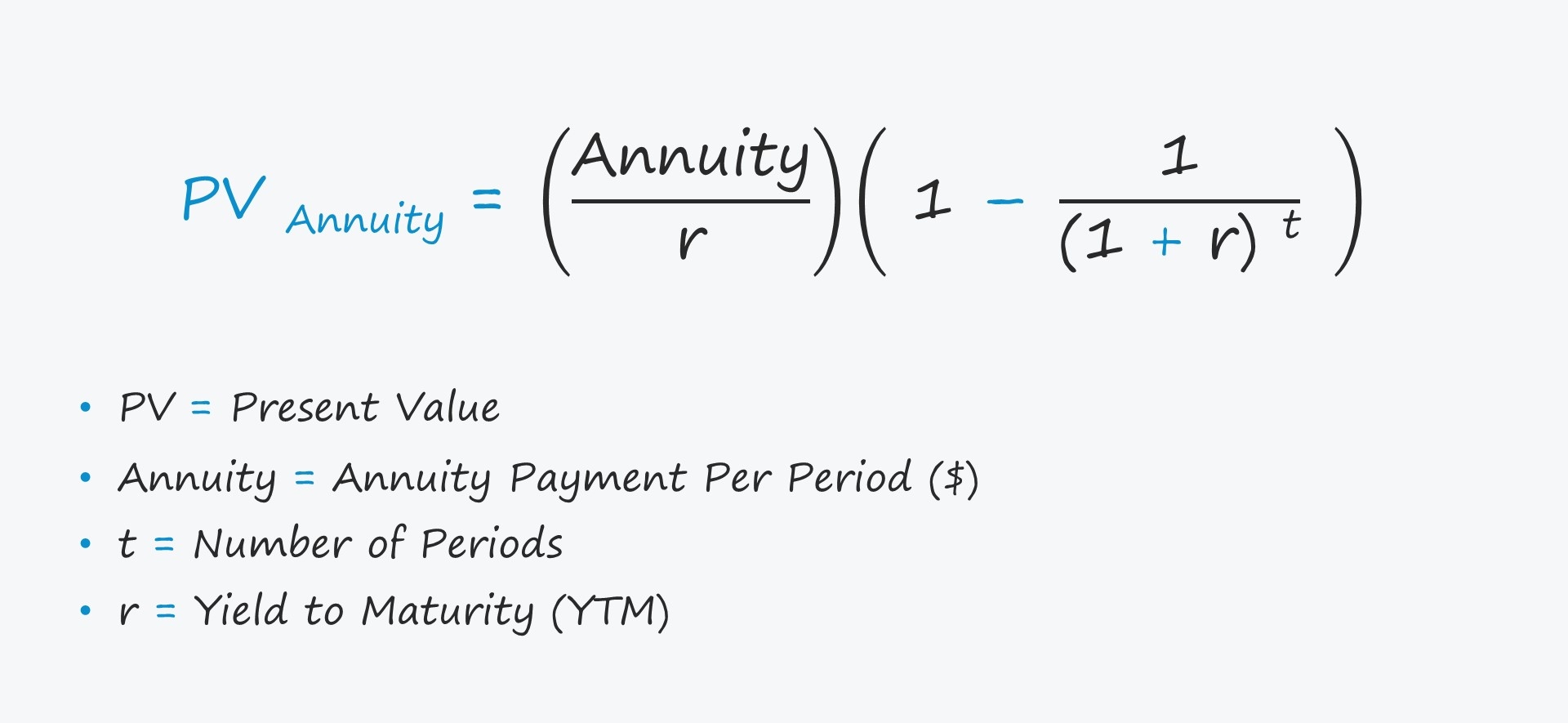

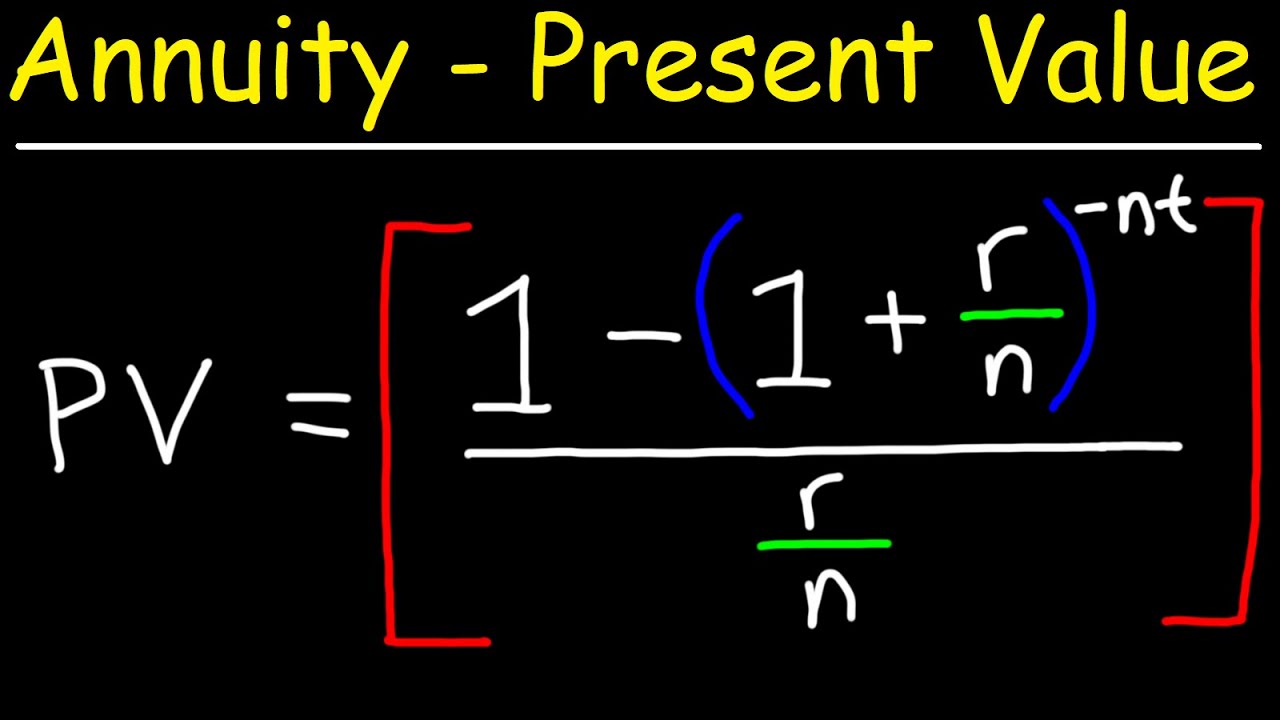

Therefore there are certain formulas to. Studying this formula can help you understand how the present value of annuity works. The basic annuity formula in Excel for present value is PVRATENPERPMT.

Excel can perform complex calculations and has several formulas for just about any role within finance and banking including unique annuity calculations that use present and future value of annuity formulas. Present Value of Pension Options. This is because the payments you are scheduled to receive at a future date are actually worth less than the.

The future cash flows of. Present Value of Annuity Due PVAD Calculator. The more important question perhaps is What rate should I use for the discount ratequot.

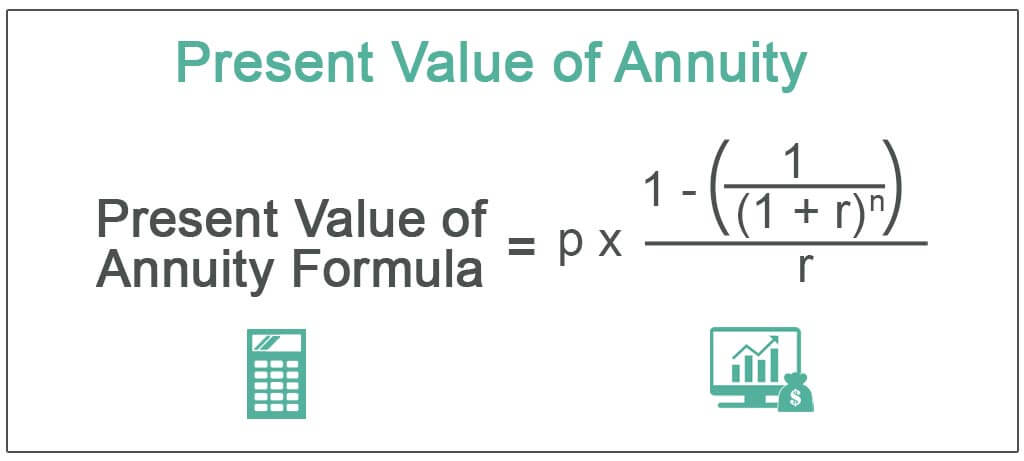

PVOA APr 1 - 11 rN. Present Value Formula and Calculator The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. The discount rate is the rate used to find the present value.

The projected sales revenues and other line items for a company can be used to estimate the Free Cash Flows of a company and utilizing the Weighted Average Cost of Capital WACC to discount those Free Cash Flows to arrive at a value for the. For example youll find that the higher the interest rate the lower the present value because the greater the discounting. Compound Interest Formula Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

The program uses this value to calculate the annuity payout the present value of the annuity payments and the present value of the remainder for gift tax purposes. Present Value Annuity Formulas. Present Value of Annuity Future Value of Annuity and the Annuity Table.

A table is used to find the present value per dollar of cash flows based on the number of periods and rate per period. The previous section shows how to calculate the present value of annuity manually. Net Present Value Definition.

Net Present Value is a frequently used financial calculation used in the business world to define the current value of cash inflows produced by a project asset product or other investment activities after subtracting the associated costs. Value from present value of an annuity of 1 in arrears table. Present Value Of Annuity Calculation.

However the table works for discrete values only. Below you will find a common present value of annuity calculation. Present Value of Annuity PV is estimated by taking account of the annuity type - If ordinary then the formula is.

Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy. Having a positive net present value means the project promises a rate of return that is higher than the minimum rate of return required by management 20 in the. And annuities tend to hold their carrying value better over time.

This means that the present value of the cash flows decreases. You can change this value however if you later change the Pre-discounted Fair Market Value the. If you anticipate a long life expectancy one option may be worth more to you in terms of present value than another option.

Of periods the interest is compounded. Insert the factor into the. Yes the equipment should be purchased because the net present value is positive 1317.

The present value annuity factor is used for simplifying the process of calculating the present value of an annuity. Present Value of an Annuity PVdfracPMTileft1-dfrac11inright1iT where r R100 n mt where n is the total number of compounding intervals t is the time or number of periods and m is the. Find out how an annuity can offer you guaranteed monthly income throughout your retirement.

The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future. Just by thinking of things intuitively by the time value of money if you have a time series of identical cash flows the cash flow in the first time period will be the most valuable the cash flow in the second time period will be the second most valuable and so forth. If you are married you ought to consider joint life expectancy in your calculations.

Present Value of Growing Annuity PVGA Calculator. How to calculate present value in Excel - formula examples.

Present Value Of Annuity Formula With Calculator

Present Value Of Annuity Calculation Knime Analytics Platform Knime Community Forum

How To Calculate Present Value Of An Annuity

Annuity Formula What Is Annuity Formula Examples

What Is An Annuity Table And How Do You Use One

Annuity Present Value Pv Formula And Calculator Excel Template

How To Calculate The Present Value Of An Annuity Youtube

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

How To Measure Your Annuity Due

Present Value Of An Annuity How To Calculate Examples

Present Value Of An Annuity How To Calculate Examples

How To Calculate Present Value Of An Annuity

Present Value Pv Of An Annuity Example Problem Youtube

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Present Value Of An Annuity Definition Interpretation

Excel Formula Present Value Of Annuity Exceljet

Annuity Formula Present Future Value Ordinary Due Annuities Efm